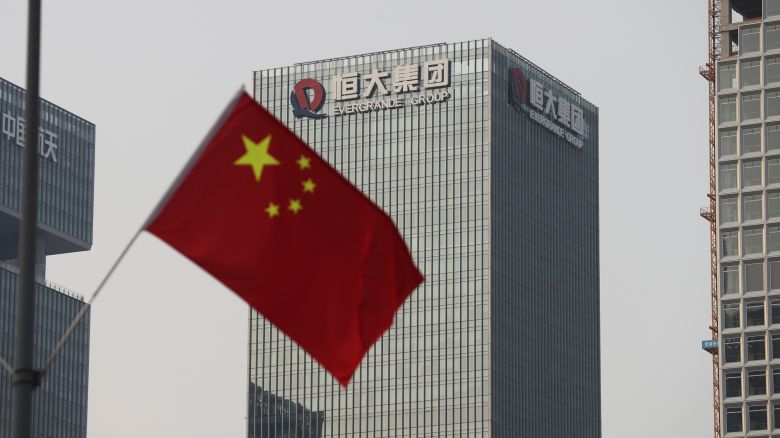

Evergrande’s woes deepen after police detain staff

The Chinese police have detained some staff of Evergrande’s wealth management unit after the company failed to repay investors, in the company’s first criminal probe since it was hit by a massive debt crisis late last year.

On Monday, the company’s shares plunged as much as 26% in Hong Kong, before recovering most of those losses to close 1.6% lower.

As part of China’s shadow banking sector, Evergrande Wealth has been raising funds from individual and corporate investors since its founding in 2015. Police in the southern megacity of Shenzhen, where Evergrande is headquartered, said Saturday they had recently detained some staff at Evergrande Wealth.

In contrast to formal banks, shadow lenders, including trust companies, operate outside of them. As a source of high-yield investments, they are lightly regulated but play a big role in China’s financial sector.

As a result of the country’s economic woes, some firms have failed and others have suffered losses, stoking fears that a bigger financial crisis may be on the way.

In addition, another Chinese shadow lender, Zhongrong Trust, admitted that some of its products could not be repaid on time and agreed to entrust two state-backed firms, CCB Trust and Citic Trust, with its management for one year.

Shenzhen police said they were investigating Evergrande Wealth’s detained employees and encouraged investors to come forward with information.

It identified one of the detainees as having the surname “Du,” but didn’t provide other details, such as when the detentions took place and the nature of the allegations.

The state-owned Shanghai Securities Journal reported that one of the detainees is the general manager and legal representative of Evergrande Wealth, citing an unnamed source.