After Microsoft deal, gaming giants are still sitting on $45 billion.

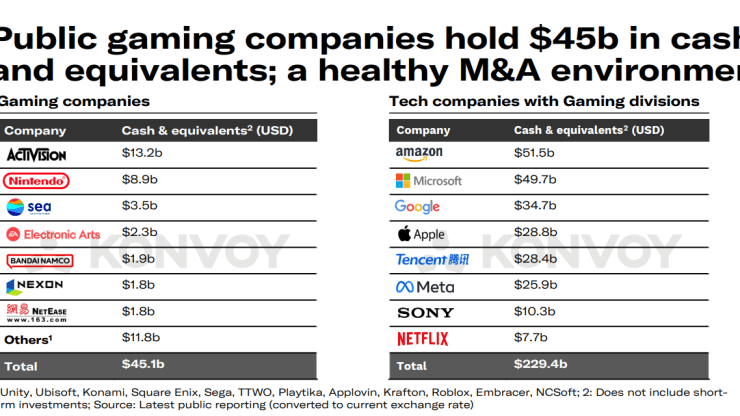

There are $45 billion in cash and cash equivalents held by publicly listed gaming companies, according to a new report from venture capital firm Konvoy, which was shared with us exclusively.

Konvoy cited the latest public reports of Activision Blizzard, Electronic Arts, Singapore’s Sea, Japan’s Nintendo and Bandai Namco, South Korea’s Nexon, and China’s NetEase, which each hold $45.1 billion in cash and cash equivalents.

Their financial firepower would allow them to consider acquiring potential intellectual property and product acquisition targets.

Gamers are more engaged for longer with live-service games that add content over time, as well as paid subscription packages which give them access to a set amount of free games and cloud gaming, or the ability to play games online rather than downloading them.

As a whole, 2023 was a fairly good year for publicly listed gaming companies.

According to Konvoy, the VanEck Video Gaming and eSports ETF has risen 20% over the past year and tracks the MVIS Global Video Gaming & eSports Index. S&P 500, on the other hand, has risen nearly 12% so far this year.

According to Josh Chapman, a partner at Konvoy, the Microsoft-Activision deal – which saw Microsoft buy U.S. game publisher Activision Blizzard for $69 billion – will likely spark more mergers and acquisitions and lead to a new generation of gaming companies.

As active gaming investors, we believe that the deal will positively impact gamers and gaming startups, as it will improve their value proposition and create an environment for other deals to be completed,” Chapman wrote in an email.

Microsoft adds Activision to its growing portfolio of game publishers through cloud gaming. Using its Xbox Game Pass subscription product, Xbox is pushing its cloud gaming service, which eliminates the need for traditional consoles like the Xbox Series X or PlayStation 5.

“This will create new opportunities for developers, gaming platforms, and infrastructure companies,” Chapman said.