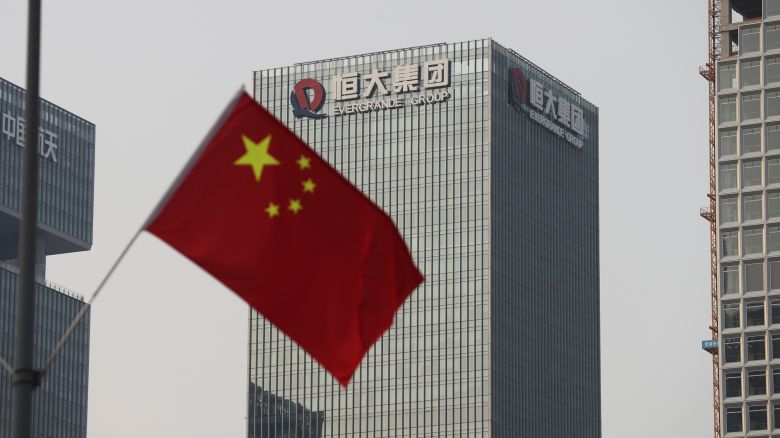

China’s Evergrande says losses narrowed by 50% in half of 2023

As a result of “the short boom of the property market” earlier this year, Evergrande Group has reported that its net losses have narrowed significantly for the first half of the year.

After a 17-month suspension, its shares plunged more than 70% on Monday, even as most Chinese property firms traded higher after Beijing further eased property restrictions.

Shenzhen-based company was one of China’s biggest property developers by sales for years. In 2021, it defaulted on its debt after borrowing heavily to fund its expansion, sparking a crisis in China’s real estate sector, which accounts for 30% of the country’s economy. Earlier this month, it applied for bankruptcy in the United States.

Because of its key role in China’s current economic woes, investors closely monitor its progress.

In a filing to the Hong Kong stock exchange on Sunday, Evergrande reported a 33 billion yuan loss attributable to shareholders in the January to June period, a 50% drop from a 66.4 billion yuan loss a year ago. There was a 44% increase in revenue from a year ago, reaching 128.2 billion yuan ($17.6 billion).

The company said it had “actively planned for the resumption of sales and successfully capitalized on the short boom in the property market that emerged at the beginning of the year.”

A post-opening rally helped the Chinese economy start the year off strongly after its strict Covid-19 restrictions were lifted. Since April, the rebound has slowed down.

According to a long overdue financial report published last month, Evergrande lost $81 billion in 2021 and 2022.

Its challenges are not over. Evergrande is still laden with liabilities worth 2.39 trillion yuan ($328 billion) by the end of June.